Despite my

traveling, having limited internet access, and forgetting all about it, on

11/7/19 $50 was sent to M1 Finance for the dividend portfolio. I'll repeat

myself: automate everything you can. It makes life so much easier.

So far $700 has been

sent to M1 since late June 2019. The account's value as of market close on

11/15/19 is $730.52, which includes $3.57 in cash. Investing the same $700 into

Vanguard's VOO ETF would be worth $739.79. The dividend portfolio is once again

lagging its Standard and Poor's 500 benchmark.

Lots of dividends

were received since the last update. See the screenshot below for details.

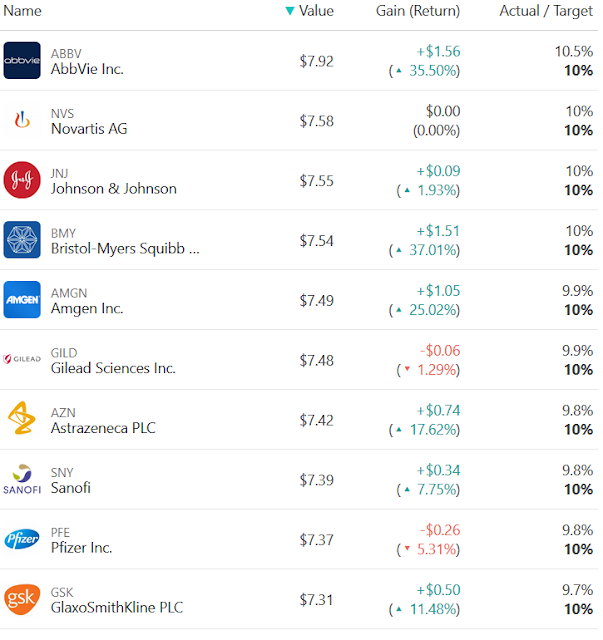

Below I am including

screenshots of the portfolio's 100 holdings, organized by sector. As a

reminder, most of the holdings were selected by their membership in iShares'

DGRO ETF (dividend growth stocks), filtered by having a dividend yield 2.5% or

higher at the time of selection.

At the time of

portfolio construction, M1 limited accounts to 100 individual holdings. You can

get around this by setting up more than one account, but I didn't do this

because it would add too much complexity to this project. If and when M1 allows

for more than 100 holdings per account, I will likely add additional stocks to

it.

For added

diversification, I also added a few international dividend paying companies.

The selections were not purely random. Rather, I selected them based on having

heard of them. I don't believe in stock research because even if you have all

the information available, the future is not predictable. All research does is

waste one's time. (But what about Warren Buffett? I shall write a post on that

at some point in the near future.)

Date

|

Additional Investment

|

Running Total Investment

|

Dividend Portfolio Account Value

|

Additional Benchmark VOO Shares

|

Running Total Benchmark VOO Shares

|

VOO Closing Share Price

|

Benchmark VOO Value

|

Dividend Portfolio VS Benchmark

|

Comment

|

6/24/19

|

$200.00

|

$200.00

|

$200.00

|

0.737844

|

0.737844

|

$271.06

|

$200.00

|

0.000%

|

|

7/2/19

|

$0.00

|

$200.00

|

$200.00

|

0.003756

|

0.741600

|

$272.23

|

$201.89

|

-0.934%

|

$1.0226

dividend received and reinvested into VOO

|

7/3/19

|

$50.00

|

$250.00

|

$252.22

|

0.182269

|

0.923869

|

$274.32

|

$253.44

|

-0.480%

|

|

7/18/19

|

$50.00

|

$300.00

|

$299.10

|

0.182202

|

1.106071

|

$274.42

|

$303.53

|

-1.459%

|

|

8/2/19

|

$50.00

|

$350.00

|

$343.48

|

0.186005

|

1.292076

|

$268.81

|

$347.32

|

-1.106%

|

|

8/16/19

|

$50.00

|

$400.00

|

$385.57

|

0.188523

|

1.480599

|

$265.22

|

$392.68

|

-1.812%

|

|

8/30/19

|

$0.00

|

$400.00

|

$389.89

|

0.000000

|

1.480599

|

$268.60

|

$397.69

|

-1.961%

|

Forgot

to transfer $50

|

9/3/19

|

$50.00

|

$450.00

|

$439.89

|

0.187189

|

1.667788

|

$267.11

|

$445.48

|

-1.255%

|

|

9/12/19

|

$50.00

|

$500.00

|

$514.39

|

0.180734

|

1.848522

|

$276.65

|

$511.39

|

0.586%

|

|

9/27/19

|

$50.00

|

$550.00

|

$563.02

|

0.180989

|

2.029511

|

$276.26

|

$560.67

|

0.419%

|

|

10/1/19

|

$0.00

|

$550.00

|

$548.87

|

0.009807

|

2.039318

|

$269.32

|

$549.23

|

-0.065%

|

$2.6412

dividend received and reinvested into VOO

|

10/10/19

|

$50.00

|

$600.00

|

$610.45

|

0.185653

|

2.224970

|

$272.13

|

$605.48

|

0.821%

|

|

10/25/19

|

$50.00

|

$650.00

|

$677.15

|

0.181232

|

2.406202

|

$277.04

|

$666.61

|

1.580%

|

|

11/17/19

|

$50.00

|

$700.00

|

$730.52

|

0.176610

|

2.582812

|

$286.43

|

$739.79

|

-1.254%

|

No comments:

Post a Comment